Table of contents

Amid rising tax pressure, regulatory complexity, and looming uncertainty, a growing number of companies are questioning whether incorporating or maintaining a headquarters in the high-tax jurisdictions still makes sense.

For international businesses, traditional, tightly regulated, high-tax jurisdictions may no longer offer an optimal environment for growth, adding a significant burden. In response, Cyprus has emerged as a viable alternative, combining competitive tax and related initiatives with legal certainty and a business-friendly regulatory landscape, making it a much-desired hub to incorporate for international groups of companies and startups.

This guide explores the key reasons behind the growing appeal to move business to Cyprus and outlines the key considerations for a successful transition.

Relocate a Business to Cyprus: Core Advantages

Moving a business to Cyprus offers a compelling combination of numerous advantages, attracting companies from Europe, the UK, the Middle East, Asia, and beyond.

1. Competitive Taxation

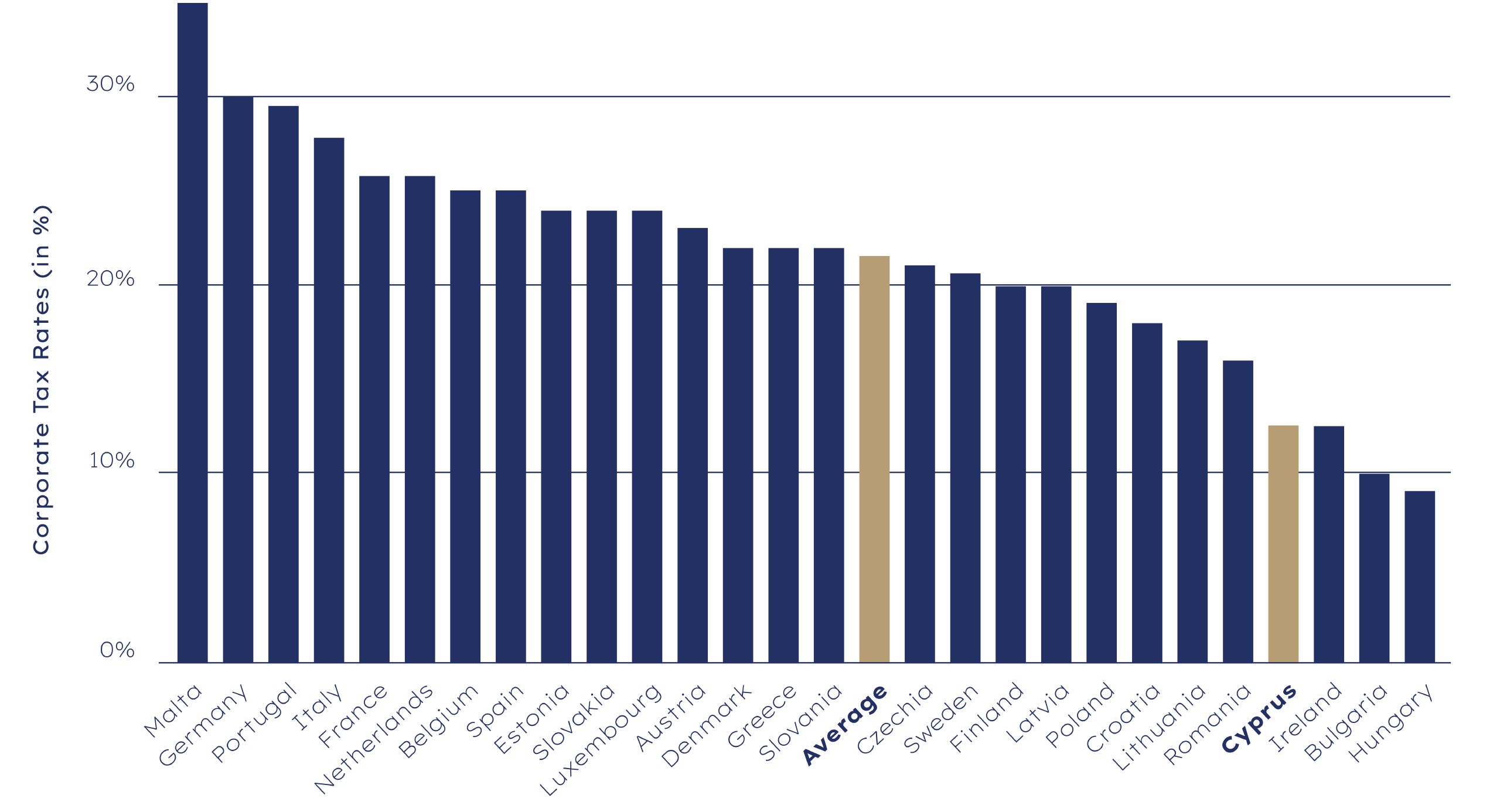

Cyprus is widely recognized for offering one of the lowest corporate tax rates in the European Union (EU), set at 12.5% (15% starting January 2026). In addition, as a general rule, royalties, dividends, or interest are not subject to the withholding tax, except in cases where the recipient receiving those payments resides in the jurisdictions determined as non-cooperative on tax matters.

Source: Tax Foundation

On top of this, Cyprus offers an IP Box regime that allows taxpayers to claim 80% of the profit generated from qualifying intellectual property assets, provided the underlying research and development (R&D) activities satisfy the nexus rules. This includes any R&D outsourced to related parties where such outsourcing is allowed. As a result, the corporate tax rate on qualifying IP income can be lowered, reaching 3-5%, further enhancing tax efficiency for companies developing intellectual property.

Along with all these tax benefits, Cyprus maintains an extensive network of over 60 double taxation treaties, significantly easing international tax burdens on companies.

2. English Speaking and EU Access (Strategic Business Hub)

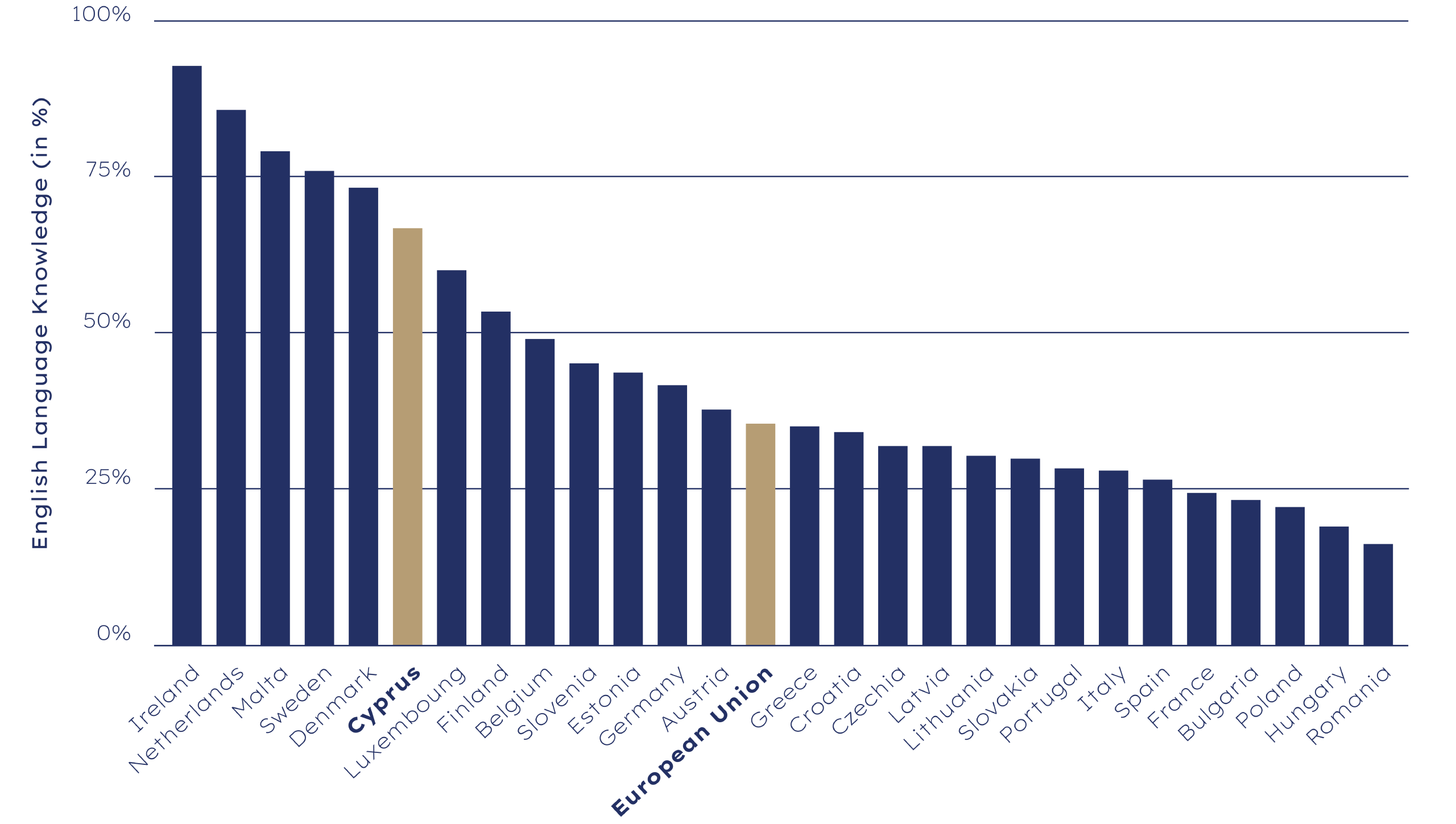

English is widely used in Cyprus for commercial activities, including business, legal, and government contexts, simplifying day-to-day operations for international companies. This significantly reduces administrative friction, eliminates the delays for translations, and minimizes the risk of potential wrong legislation interpretation.

Source: European Commission

Due to a mix of a business-friendly tax framework, a large pool of English-speaking professionals, and trading access to the European Union market, Cyprus has become one of the leading choices for business operations in the EU.

3. Ease of Doing Business

Setting up a company in Cyprus is a relatively straightforward process, with clear procedures and predictable timelines. The whole process may be carried out by an authorized person who can submit incorporation applications with the Cyprus Registrar of Companies online or onsite.

From the moment a Cyprus corporate provider has received all required documents, the incorporation process typically takes around 2 weeks, subject to regulatory processing timelines.

4. High Quality of Living

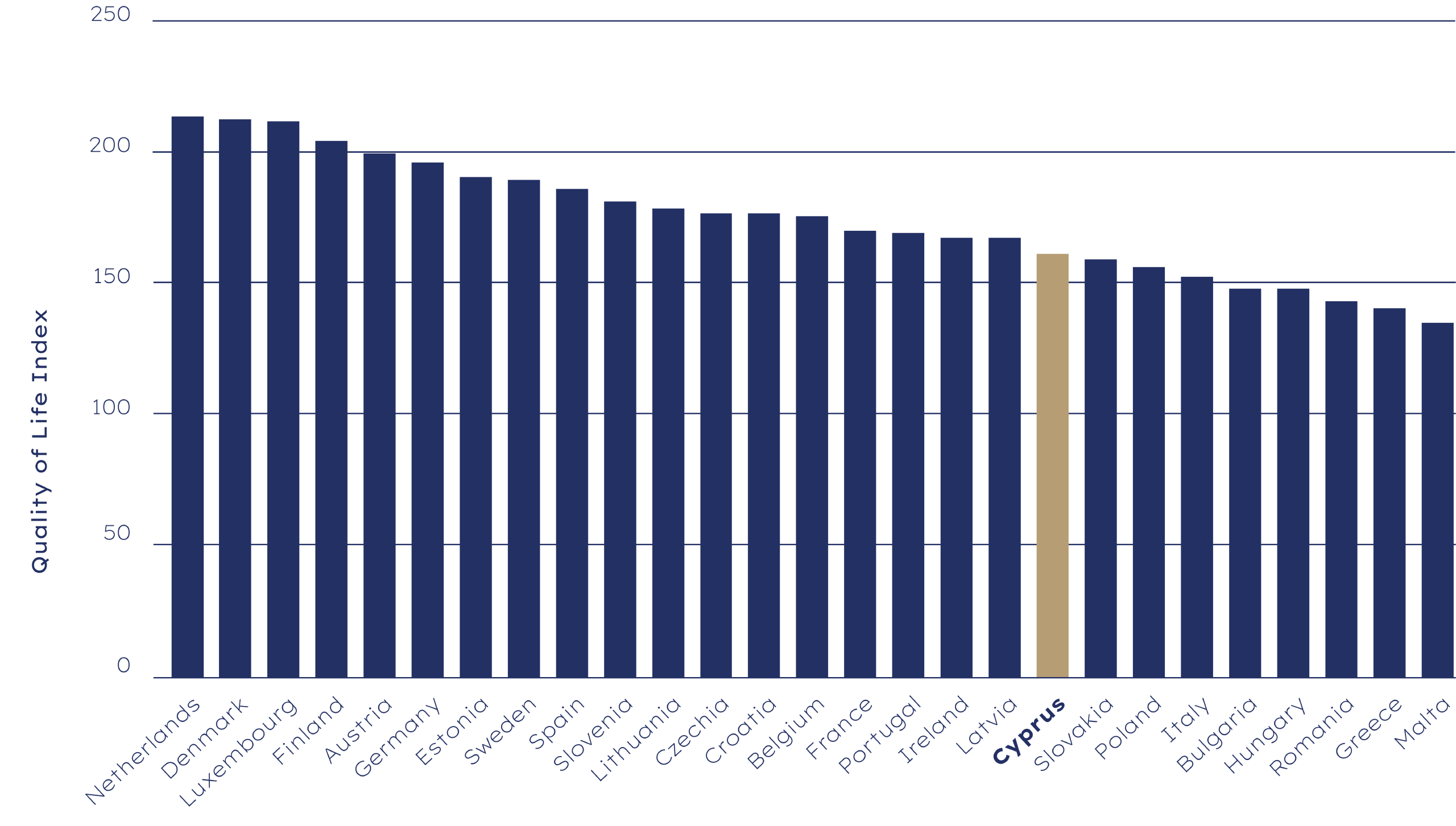

For businesses requiring physical relocation, Cyprus offers a “very high” quality of living, supported by a favorable climate, modern infrastructure, and a predominantly sunny climate, combined with various migration and residence options. All of these made Cyprus attractive for relocating the whole teams and/or senior management.

Source: Numbeo

5. Affordable Business Costs

Compared to many EU member states, Cyprus maintains relatively affordable costs of launching and operating a business. Office rentals, professional services, and wagers remain competitive enough for optimizing overheads without compromising on quality or compliance.

Yet, depending on the nature and scale of the business, entrepreneurs should carefully consider applicable VAT rules, potential VAT registration obligations, fees for professional service provider engagement (legal, accounting, audit), and other operational and compliance-related costs.

6. Favorable Regulations

Cyprus offers clear regulations across a wide range of industries, from technology and intellectual-property-driven businesses to traditional trading companies dealing in commodities or consumer products. Regulatory authorities are accessible, processes are well-defined, and all requirements are relatively clear and transparent.

How to Open or Relocate a Business in Cyprus: A Step-by-Step Guide

The full relocation of a business to Cyprus is a more complex process than simple company formation. Depending on the scope and type of assets to be transferred, the nature of the business activities, and other various factors, full relocation (redomiciliation) may take from 8 to 10 weeks, on average. However, banking, licensing, relocation of staff, and substance may extend the overall timeline.

In most cases, the Cyprus company formation can be completed within 2 weeks, provided all documentation is complete and properly prepared. However, the process can take longer, given the possible delays in the company’s name approval and the need for preparing the incorporation documents prior to submitting them to the Registrar of Companies, among others.

Below is the step-by-step process for company relocation in Cyprus:

1. Hire a Legal Professional

A Cyprus-experienced professional will prepare all required documents, including the Memorandum and Articles of Association and the statutory Registrar forms (HE1, HE2, and HE3) covering statutory declarations, registered office particulars, and director appointments.

2. Select a Legal Structure and Register a Corporate Name

The next step involves selecting a suitable legal form, the most popular choice often being a private limited liability company (LLC). An application for approval of a company name must then be submitted, while taking into account that it shall be unique and compliant with statutory requirements.

3. Submit the Required Documents to RCOR

Once the name is approved, incorporation documents are filed. A Cyprus professional will submit the online incorporation request, attach all necessary documentation for the Registrar of Companies, and oversee the entire process on the company’s behalf. For relocation purposes, additional documentation from the home jurisdiction may be required to demonstrate legal continuity.

4. Receive the Company Incorporation Certificate

Upon successful registration, the Registrar will issue the certificate of incorporation and articles of association. At this point, the company legally exists and may proceed to operate.

5. Register with the Tax Department and Open a Corporate Bank Account

Once incorporated, the Cyprus entity is required to register with the Cyprus Tax Department for corporate tax purposes and, depending on the turnover, for value-added tax. In addition, the opening of a corporate bank account is a necessary foundation for the proper and lawful operation of any business.

6. (Optional) Apply for Necessary Licenses

Certain business activities – finance, crypto, or gambling-related – require specific licenses (regulatory authorization). Applications shall be submitted to relevant authorities, with timelines varying depending on the jurisdiction and project complexity.

7. Transfer of Assets & Operations

For businesses relocating, all necessary contractual assets, contracts, and intellectual property may need to be transferred to the new Cyprus company. With the right legal guidance, this could be done to avoid tax inefficiencies or other disruptions.

8. Establish Local Presence

Establishing a local presence is a vital step; this typically includes the appointment of a local director, the establishment of a physical office for Cyprus-based employees, and the holding of board and general meetings in Cyprus.

9. Ongoing Compliance Support

After establishment, the company must meet ongoing obligations, including annual audits, tax filling, and other measures to ensure long-term compliance and operational stability.

Cyprus Residential Permits for Entrepreneurs

Cyprus offers an attractive and well-regulated residence framework for non-EU entrepreneurs seeking to live and operate within the country. Residential permits under the Cyprus Residence Permit Program (Permanent Residence Permit by Investment or Cyprus Category F / Business Investment PR route) are designed to support genuine economic activity while providing legal certainty and long-term stability for the founders and their families (who may qualify for residence permits in certain cases).

Non-EU applicants seeking to obtain a permanent residence permit under this program must meet the following criteria:

- Investment. Among other options, a minimum investment of EUR 300,000 must be made in the share capital of a Cyprus company through the purchase of shares. The investment funds must be transferred to Cyprus from abroad. The Cyprus company that receives investment must have an actual physical presence and active operations in Cyprus and must employ at least five (5) employees.

- Secured income. The applicants should demonstrate a secure annual income of at least EUR 50,000, increased by EUR 15,000/10,000 for each dependent person (spouse and children).

- No criminal record. The applicant and each adult family member must provide a clean criminal record from the country of origin or the country of residence, if different.

- Residence. Applicants must provide evidence of accommodation in the Republic of Cyprus, either through a property purchase agreement or a valid rental (lease) agreement.

The application process involves submitting the required documentation to the relevant authority; it must be properly structured and supported by evidence of business activity and financial stability. With professional guidance from law firms like Inteliumlaw, residence permits for entrepreneurs who move a company to Cyprus can be obtained efficiently and seamlessly, allowing them to establish a presence in the region with legal confidence.

Final Thoughts: Why Inteliumlaw for Business Relocation to Cyprus?

Relocating a business to Cyprus offers significant advantages, including high tax efficiency, EU market access, and a stable legal framework. These factors make Cyprus an attractive jurisdiction for companies seeking a reliable HQ for long-term growth, operational flexibility, and unparalleled global credibility.

At Inteliumlaw, our experts provide hands-on support with setting up a company in Cyprus, covering document preparation, establishing an office, staff relocation, banking services, and post-incorporation ongoing legal services (accounting, tax, and audit compliance matters). With an on-site presence in Cyprus, our team ensures smooth coordination with local authorities and provides end-to-end support throughout every stage of the process.

Contact Inteliumlaw for professional guidance and tailored support to open or move a business in Cyprus, a country with one of Europe’s most competitive tax regimes.